Business Continuity Plans for the Midmarket Overcoming the Challenge

Has your business undergone a major disruption or setback recently?

As your company moves toward the resumption of operations, one of the first tasks should be to put together a business recovery and continuity plan that forces your team to push past immediate and short-term thinking.

If you're able to pause during the crisis (instead of waiting until it's nearly over) and begin creating a medium-term plan for how your company should adapt its operations, then you'll be better prepared to outperform businesses that wait to adjust.

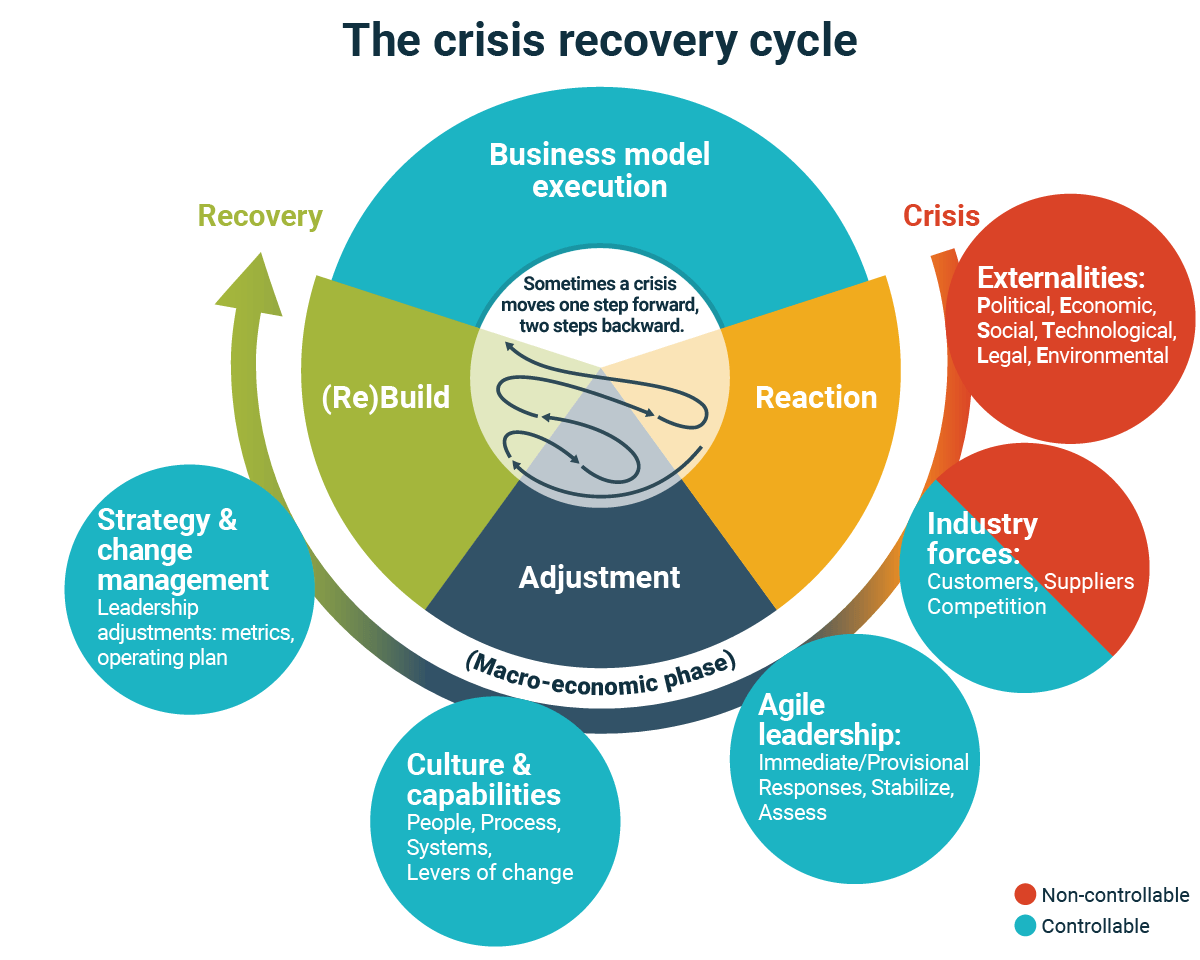

There are three identifiable phases of crisis recovery:

- Reaction

- Adjustment

- (Re)build

By working through each phase with your leadership team, you can increase the effectiveness of both company and stakeholder responses with business scenario planning:

- First, examine any externalities and projected market movements.

- Then, compare those outside variables against your current capabilities.

- Finally, prepare your business for the emerging opportunities that result.

The crisis recovery cycle

A crisis could be any significant market, industry or internal disruption, severe economic downturn or a pandemic. Or, it could be internal (like a business scandal).

Phase 1: Reaction

This is your immediate response to what has just happened. Your focus should be on:

- Adopting a mindset of agility to become a flexible, supportive leader

- Assessing the situation and determining the nature of the crisis (single instance or episodic)

- Considering the economic situation, any resulting industry forces or reactions, and identifying how other companies are adjusting or taking action

- Evaluating cash position and burn rates, as well as how to facilitate essential operations

- Gathering inputs or information to start initial planning for short- to immediate-term stabilization

- Creating and sticking to a communication plan for your team (employees) and stakeholders in your business (customers, vendors, partners, investors, board, etc.)

Phase 2: Adjustment

This is where you focus on short-term stabilization.

Depending on the type of disruption, your adjustment phase may be either:

- Linear (when the crisis is a single instance, like an earthquake), or

- Episodic (for instance, a pandemic may come in waves)

This will influence your adjustment and scenario planning.

- Take the time to acknowledge the concerns and fears of your team. This includes their physical, mental and emotional safety and well-being.

- Assess how you'll need to adjust employees' roles and use of resources.

- Start implementing action to mitigate the impacts of the crisis immediately.

- Delegate responsibilities to give your team a mission and renewed sense of purpose.

Big picture questions that a leader should ask of themselves and senior team in assessing the future:

- What's the biggest disruption or potential disruption(s) to your business?

- What's one thing that you're sure of (that's offered a sense of calm through the storm)?

- What's one thing you're thinking about now (that you wish was clearer)?

- What's something you're optimistic about?

Phase 3: Rebuild

This is when you begin to frame the "new normal" and decide how to move forward for the longer term. Part of this is involves identifying and planning future scenarios for your business.

Phase 3 and phase 2 can (and often should) happen concurrently. You'll want to support your employees' adjustments to the current state (phase 2), while strategically and proactively framing multiple scenarios for business recovery – or a new business direction – based on the post-crisis landscape (phase 3).

Business scenario planning can also involve several trips through this cycle as the crisis develops and new variables come into play that impact your company.

As the model shows, in many cases a crisis is not a linear event with a clear beginning, middle and end. Many crises, such as a pandemic, can be episodic and come in waves.

As soon as you adjust and make plans for recovery, an externality may shift and call for a modified response.

3 advantages of scenario planning

1. Scenario planning is an opportunity to shift from a reactive to a proactive approach.

This activity jolts you out of the common inclination to prepare only for the month ahead. Instead, it nudges you to look farther into the future – perhaps 12 to 18 months out.

This can help you prevent unpleasant surprises and avoid being caught unprepared for a situation you didn't foresee, which could set back your business' recovery.

Having a plan for stakeholders – and a few backups – automatically makes you feel more in control and increases the likelihood that your business will successfully navigate the challenge at hand.

2. The scenario planning process forces you to become less complacent and a more intentional, flexible and agile leader.

This is a good thing, because change is constant in the workplace – especially so after a major business disruption.

As the situation continues to unfold and evolve, you may be faced with additional changes that will test yourself or your team. Don't get discouraged. Scenario planning will help.

3. By its very nature, scenario planning requires letting go of what makes you comfortable.

You may have to possibly face an altered market, industry or operating landscape, and challenge your assumptions about what "business as usual" will look like moving forward.

Engaging in this exercise can help you to adopt a mindset of resilience in which your tolerance for uncertainty and ambiguity increases along with your confidence. Your thinking can then shift toward:

- Facilitating innovation

- Considering what's possible

- Embracing opportunities rather than being trapped in a pessimistic, fearful state

Business scenario planning process

Step 1: Assess the nature and extent of residual uncertainties.

Get leadership and all relevant parties together to assess the situation.

Examine the externalities that are out of your control:

- What's going on in the industry?

- What are the political, social, economic, legal, technological and environmental considerations?

- Discuss the opportunities and threats your company faces. This is a great time to update your business canvas or conduct an updated strength, weaknesses, opportunities and threats (SWOT) analysis.

Talk to suppliers, customers and competitors to get their opinions on where the industry might be headed. Solicit their feedback and recommendations.

Review what you learned about your company during the crisis and discuss the internal state of your company post-crisis. This analysis could center on:

- Capabilities

- Challenges

- Staff level and skills

- Workplace culture

- Mission, vision and values

- Organizational structure

- Leadership (especially their performance during the crisis)

Consider what won't be the same post-crisis. This could include your:

- Business model

- Revenue and cost structures

- Business processes and workflows

What are the cost impacts of making these changes?

In general, what are you most optimistic about?

With all this in mind, consider the likely future direction of your business.

- Will your business continue, for the most part, as it was pre-crisis?

- Will your business branch out in a new direction?

- Will you start a completely new business?

Each of these options requires varying levels of organizational- and change-management skill, time and resources across people, processes and systems.

To understand what this looks like, let's take an example using a restaurant – a type of business significantly impacted by the COVID-19 pandemic. As part of a restaurant's recovery from this particular crisis, they could:

- Continue: Reopen and resume normal operations.

- Branch: Add a delivery model, incorporate a pop-up grocery store inside their facility or introduce a new or limited type of menu or catering.

- Start a new business model: License their name to another company, and do a new joint venture.

Everything discussed at this stage – an analysis of internal and external conditions, as well as the potential future direction of your business – is a jumping-off point in brainstorming scenarios.

Step 2: Identify the most likely scenarios and develop strategic postures for each.

As you build your portfolio of scenarios, solidify how you can best implement the scenarios given the assets you have. Consider which assets you need to focus on and develop further.

The ideal number of scenarios is three. The maximum number is about five.

Too few scenarios put you at risk of being insufficiently prepared and results in mere stopgap solutions that must be constantly revisited. On the other hand, too many scenarios could mean you're bogged down in the planning stage and are becoming slow to execute.

This shouldn't be a lengthy, overly complicated process that hinders your business' forward momentum. Identify the factors that are most relevant to your business, make plans that address these issues and take action.

Step 3: Actively manage the strategic direction while maintaining the flexibility to shift.

Remember, your business may go through the crisis cycle more than once. This is why you need to be open to reconsidering and adapting your approach as needed. A flexible and agile mindset can increase your odds of success.

Continue to practice robust management:

- Communicate with your team about all changes.

- Engage your team and help them to develop a mindset of resilience.

As long as your business remains in a disruptive, fast-moving environment, you may need to reevaluate your planned scenarios every 21 to 30 days.

As the environment normalizes, expect to review these planned scenarios every 90 days to six months.

Common scenario-planning mistakes

- Not staying true to your customer promise

- Not creating a culture that allows people to share ideas freely

- Having leaders who are too focused on today's work

- Thinking too narrowly about your opportunities

- Reflexively prioritizing budget and staff reductions first, as opposed to considering pathways to growth and how your people can be part of that growth

Remember, new markets and opportunities are most often created on the fringes.

How a PEO can help

A multifaceted professional employer organization (PEO) won't tell you what to do. However, it can help to facilitate and guide the conversations and processes within your company and can help to stretch perspectives on what the future of your business could look like.

The scenario-planning process is a bit like visiting a buffet. You have a lot of different options before you, along with many factors to consider. Everything's right in front of you – a PEO can help you make sense of it.

Nobody has all the answers for overcoming a major business disruption. You don't have to figure it out all by yourselves. Leverage the resources at your disposal.

Summing it all up

Scenario planning with multiple options is a must for any company going through the challenges associated with business recovery and continuity. Among the advantages are:

- Developing a proactive, opportunities-centric mindset

- Avoiding unpleasant surprises

- Becoming more agile and flexible

If you take the appropriate steps and consider all the relevant factors when planning scenarios, your company can emerge from any crisis as stronger, more resilient and better prepared.

But remember – this is not a one-and-done process. Most crises are by nature episodic and force us to continue to adjust and re-adjust.

For more information on how a PEO can help your business, download our free e-book: HR outsourcing: A step-by-step guide to professional employer organizations (PEOs).

Additional contributor: Rodney Satterwhite, MBA

Source: https://www.insperity.com/blog/business-recovery-and-continuity-planning/

0 Response to "Business Continuity Plans for the Midmarket Overcoming the Challenge"

Post a Comment